Michał Głowacki, University of Warsaw

Katarzyna Gajlewicz-Korab, University of Warsaw

Dagmara Sidyk-Furman, University of Warsaw

Publication date: December 2025

DOI: 10.25598/EurOMo/2025/PL

Report produced under the EC Grant Agreement LC-03617323 – EurOMo 2025, Directorate-General for Communications Networks, Content and Technology Media Policy. The contents are the sole responsibility of the author(s) and do not necessarily reflect the views of the European Commission. This report © 2025 by Euromedia Ownership Monitor (EurOMo) is licensed under CC BY 4.0

This report presents Poland’s national findings from the Euromedia Ownership Monitor (EurOMo) – a multilayered cross-cultural methodology towards media ownership transparency across the EU member states. This 2025 study edition builds on methodological advances in EurOMo by adding social news media accounts to the country sample and updating the Polish 2023 news outlets sample to capture different sides of politically driven socio-political divides. The study examines the state of media ownership transparency under the broad liberal coalition Government led by Donald Tusk (since December 2023) and President Karol Nawrocki, who represents the conservative side of society (since August 2025). In particular, the contested status of public service media (PSM): Telewizja Polska (TVP) and Polskie Radio (since December 2023), and the highly polarised media and associated political environment, which highlight the ongoing vulnerability of Polish media to media capture and underscore the urgency of actions to strengthen Poland’s media ownership transparency, plurality, and integrity.

This study builds on the study of 34 news media – legacy outlets and social media accounts – conducted in 2025, in accordance with the EurOMo methodology for an online database and the European transparency risk index (Tomaz, 2024) and the overall local key ownership trends (Głowacki, et al., 2023). The report further identifies three extant interrelated challenges affecting media ownership transparency: data fragmentation, limited accessibility, and constrained traceability. Together, these factors point to the multilayered dualities in media ownership transparency in Poland, which on one hand, reveal persistent obstacles to formal compliance arising from outdated and fragmented media regulation. But, on the other hand, they reflect a condition of structural secrecies, characterised by complex ownership arrangements, the use of offshore entities, and the involvement of anonymous actors operating with limited accountability.

Poland has one of the largest media markets in Central and Eastern Europe. The news market is undergoing dynamic legal and cultural transformations while still reflecting structural characteristics inherited from the pre-Internet era. These legacy features include extensive ownership transitions and regulatory frameworks originating from the early broadcast era, which are slowly adapting to the Age of Platforms (Jędrzejewski, 2024; Johnson et al., 2025). Despite legislation intended to promote transparency in media ownership, significant challenges remain in identifying and disclosing the real beneficial owners of media companies and political connections. Ownership transparency remains a central challenge, as a turn towards media accountability and transparency online has not yet been fully leveraged to reflect on Internet opportunities across the stages of news production.

Hidden ownership structures and secretive business relationships further complicate efforts to ensure transparency and contribute to a troubled polarisation and toxic news media environment. Since 2005, political power has been concentrated within two dominant media-political tribes, resulting in a high level of social and journalistic polarisation that has also affected media journalists (Dobek-Ostrowska, 2019; Głowacki & Kuś, 2022). Debates around the legacies of media reprivatisation and “repolonisation” have intensified and are closely linked to broader discussions of ownership concentration, national identity, and the perceived legitimacy of foreign or domestic ownership in Polish media (Donders, 2021; Štětka & Mihelj, 2024).

Transparency in media ownership is increasingly viewed as a political issue rather than solely a regulatory matter. The Polish Media Pluralism Monitor assessment suggests the market poses a high risk to media plurality and political independence, alongside other critical factors in European and global media freedom vs illiberal turns (Bennett & Kneuer, 2023; Klimkiewicz, 2025). This includes the latest reports on the problematic nature of the legal status of PSM and recent reports pointing to limited internal pluralism, noting extremely high government influence on editorial boards and management of PSMs (Reporters Without Borders, 2025).

In response, researchers have employed careful data-sampling strategies designed to reflect the media’s position within a specific established media sector and its relevance to socio-political diversity. The platforms-based news include both ALO (Account Linked to Organisation), which is tied to a legal entity (organization) and IAP (Independent Account on Platforms) – not tied to a legal entity, but people—an individual, a collective, or anonymous (Table 1).

Table 1: Sample of Polish media outlets and a selection of recent Media Group ownership / control changes (internal, external, planned, completed and rejected).

| No. | Outlet | Market | Media Group | Dominant shareholders (owners)* |

| 1. | Gazeta Wyborcza | Newspapers | Agora1 | Powszechne Towarzystwo Emerytalne PZU S.A. (17.68%) Agora-Holding sp. z o.o. (11.60%), Media Development Investment Fund. Inc. (11.49%), NATIONALE-NEDERLANDEN Powszechne Towarzystwo Emerytalne S.A. (8.84%) |

| 2. | Radio ZET | Radio | ||

| 3. | Radio Zet TikTok profile (@radio.zet) | Online – ALO | ||

| 4. | Polsat | TV | Cyfrowy Polsat (Grupa Polsat Plus)2 | Zygmunt Józef Solorz (62.04%, also via TiVi Foundation), Nationale-Nederlanden Powszechne Towarzystwo Emerytalne S.A. (6.40%), Tobias Markus Solorz (1.57%, also via Tobe Investments Group Limited), |

| 5. | Polsat News | TV | ||

| 6. | Polsat TikTok profile (@polsat) | Online – ALO | ||

| 7. | Interia.pl | Online – website | ||

| 8. | Radio Eska Facebook profile (https://www.facebook.com/radioeska) | Online – ALO | Grupa ZPR Media (via Time S.A.) 3 | Zbigniew Jan Benbenek and Agata Elżbieta Benbenek via Zjednoczone Przedsiębiorstwa Rozrywkowe S.A. (75% shares of Time S.A.), as well as Murator IBS sp. z o.o. (15%), Finkorp sp. z o.o. (10%) |

| 9. | Sieci | Magazines | Fratria4 | Apella S.A. (56.26%), Spółdzielczy Instytut Naukowy G. Bierecki sp.j. (28.01%), Jacek Karnowski (16.25%) |

| 10 | wPolsce24 YouTube channel (@TelewizjawPolsce24) | Online – ALO | ||

| 11. | Oko.press | Online – website | – | Fundacja Ośrodek Kontroli Obywatelskiej OKO (100%) |

| 12. | Rzeczpospolita | Newspapers | Gremi Media5 | Pluralis B.V. (38.62%), KCI S.A. (28.92%), Central International Korlátolt Felelősségű Társaság (13.43%) |

| 13. | RMF FM | Radio | Grupa RMF (part of Bauer Media) | Yvonne Saskia Bauer (85.00% shares; 43.35% votes), Heinz Heinrich Bauer (0.00% shares, 49% votes) – all via Heinrich Bauer Verlag KG |

| 14. | Kanał Zero YouTube channel (@KanalZeroPL) | Online – ALO | Kanał Zero | Krzysztof Stanowski (75%) |

| 15. | Tygodnik Do Rzeczy | Magazines | PMPG Polskie Media | Michał Maciej Lisiecki (58.36%), Katarzyna Anna Gintrowska-Lisiecka (5.98%) |

| 16. | Polityka | Magazines | Polityka | Jerzy Baczyński (19%) via Polityka sp. z o.o. |

| 17. | Gazeta Pomorska | Newspapers | Polska Press | Skarb Państwa / State Treasury (49.90%) and NATIONALE-NEDERLANDEN Powszechne Towarzystwo Emerytalne S.A. (5.45%) – all via Orlen S.A. (100% shares of Polska Press sp. z o.o.) |

| 18. | Program I Polskiego Radia (Jedynka) | Radio | Polskie Radio | Skarb Państwa / State Treasury (100%) |

| 19. | Radio Maryja | Radio | – | Prowincja Warszawska Zgromadzenia Najświętszego Odkupiciela (100%) |

| 20. | Newsweek | Magazines | Ringier Axel Springer Polska | Michael Ringier, Evelyn Lingg-Ringier and Marc Walder (10%) via Ringier AG, as well as Friede Springer and Mathias Döpfner (jointly 98% of Axel Springer SE) |

| 21. | Fakt | Newspapers | ||

| 22. | Onet.pl (Onet) | Online – website | ||

| 23. | TVP 1 | TV | Telewizja Polska (TVP) | Skarb Państwa / State Treasury (100%) |

| 24. | TVP Info | TV | ||

| 25. | Telewizja Republika | TV | Telewizja Republika | Słowo Niezależne sp. z o.o. (23.20%), Niezależne Wydawnictwo Polskie sp. z o.o. (20.80%), Tomasz Sakiewicz (16.10%), Telewizja Republika S.A. (11.60%), Fundacja Niezależne Media (unknown) |

| 26. | Telewizja Republika YouTube channel (@Telewizja_Republika) | Online – ALO | ||

| 27. | TVN | TV | TVN (part of Warner Bros. Discovery) 6 | The Vanguard Group, Inc. (10.38%), BlackRock, Inc. (7%), State Street Corporation (6.82%) – via Warner Bros. Discovery, Inc. |

| 28. | TVN24 | TV | ||

| 29. | TVN24 Facebook profile (https://www.facebook.com/tvn24pl) | Online – ALO | ||

| 30. | Tygodnik Powszechny | Magazines | Tygodnik Powszechny | VESPER INVESTMENTS S.A.R.L (37.51%), Fundacja Tygodnika Powszechnego (unknown), Fundacja Centrum Kopernika (unknown) |

| 31. | WP.pl (Wirtualna Polska) | Online – website | Wirtualna Polska | Jacek Świderski (12.69%, also Orfe S.A.), Michał Wiktor Brański (12.68%, also 10X S.A.), Krzysztof Daniel Sierota (12.67% (also via Albemuth Inwestycje S.A.), Powszechne Towarzystwo Emerytalne Allianz Polska S.A. (12.08%) |

| Independent accounts on Very Large Online Platforms: | ||||

| 32. | Łukasz Bok – Konflikty i Katastrofy Świata Instagram account (@lukaszbok_kiks) | Online – IAP | Konflikty i Katastrofy Świata | Łukasz Bogusław Bok (49%), Szymon Jan Hojeński (35%), Bartosz Paweł Szafran (16%) – all via Lepsze Media sp. z o.o. |

| 33. | MakeLifeHarder Instagram acount (@make_life_harder) | Online – IAP | – | Karolina Bacia (100% – running a sole proprietorship under the name Make Life Harder Karolina Bacia) |

| 34. | The Poland News X profile (@thepolandnews_) | Online – IAP | Anonymous | |

KEY: ALO—Account Linked to Organisation; IAP— Independent Account on Platform

* Focusing on beneficial owners (natural persons), when identifiable. Otherwise, the relevant corporations.

The sample of legacy and online-only news media includes ownership transparency examination of major cross-media corporations such as Grupa Polska Plus (Cyfrowy Polsat), Warner Bros. Discovery (TVN), Agora (Gazeta Wyborcza, Radio Zet), Ringier Axel Springer (Fakt, Newsweek Polska, Onet.pl), Bauer Media (Grupa RMF), and ZPR Media (Radio Eska). Platform-based news in the Polish sample are the MakeLifeHarder Instagram account, The Poland News on X, Łukasz Bok – Konflikty i Katastrofy Świata Instagram account, and Kanał Zero, a YouTube-based channel run by a journalist who was also a presidential candidate in the 2025 general election (Reuters Institute, 2025).

The blend of media and politics in Poland calls for an in-depth examination of socially relevant news media to address the socio-political realities of the so-called liberal-conservative media polarisation. On the surface, the sample examines conservative media brands, including Fratria (Sieci, Wpolsce24), PMPG Polskie Media (Tygodnik do Rzeczy), and Telewizja Republika, a 24-hour news channel that ranked fourth among the most popular television stations in 2025 (WirtualneMedia.pl, 2025a). The liberal media point of view is represented by Polityka (weekly), Tygodnik Powszechny (weekly), as well as TVN and Ringier Axel Springer Polska. To this end, political battles over Orlen (Gazeta Pomorska) alongside the current status of the liquidation of TVP and Polskie Radio (as of December 2023) have sparked high polarisation, becoming a subject of political conflict between the broad liberal Government and the conservative-right opposition (International Federation of Journalists, 2023; Głowacki, 2024).

Legal Forms

The ownership landscape of the Polish media sector is predominantly shaped by private limited companies. Most media outlets in Poland operate under commercial law, primarily as limited liability companies (spółka z ograniczoną odpowiedzialnością – sp. z o.o.) or joint-stock companies (spółka akcyjna – S.A.). Public service media are likewise organised as joint-stock companies, with ownership vested in the State Treasury. This model combines state ownership with the application of commercial company law, particularly with respect to accounting and financial reporting.

The media ownership sample for Poland also includes non-governmental organisations, such as foundations and associations, as well as religious legal entities. One example is the Catholic multimedia group associated with the foundation, founded by Father Tadeusz Rydzyk, which operates media outlets such as Radio Maryja, Nasz Dziennik, and Telewizja TRWAM. Furthermore, several media organisations are owned, directly or indirectly, either wholly or partially, by the State Treasury, including public service media and commercial media groups such as Polska Press, which is owned by the state-controlled energy company Orlen.

The EurOMo analysis also identified instances of complex ownership The EurOMo analysis also identified instances of complex ownership arrangements involving so-called “shell companies”. These structures consist of multiple interconnected entities and appear to serve the purpose of complicating ownership chains. Therefore, we argue, they can reduce transparency regarding capital flows and hidden media-political relationships.

Main Ownership Trends

There are several structural features of the development of the Polish media market. The starting point comprises the outcomes of the socio-political transformation of 1989, followed by the adoption phases of global media trends such as social media, platformisation, and, most recently, newsroom strategic moves towards tools offered by generative AI. Still, market trends involve a blend of national and international ownership, with investments from Germany, Switzerland, Liechtenstein, Luxembourg, the Netherlands, and the USA. In addition, many relevant shareholders in Polish media hold extensive interests in non-media and regulated sectors, including banking, energy, telecommunications, construction, and insurance.

One risk in assessing media ownership and transparency has been the registration of media companies outside Poland. This is the recent case of the TiVi Foundation (linked to Solorz), which exerts influence over Cyfrowy Polsat, as the family conflict between Solorz-Żak and his children over ownership was litigated in Cyprus and Liechtenstein (Money.pl, 2025). Finally, among key trends has been the traditionally high level of market dynamics. The plethora of recent ownership changes include the merger of Fratria with advertising agency Apella (Press.pl, 2025), the family succession at ZPR Media (Wirtualnemedia.pl, 2025b), and the acquisition of Gremi Media by PTWP with related changes in the board of management (Wirtualnemedia.pl, 2025c).

Bearing in mind the current state of Poland’s media regulation, as well as multiple sources and data, we identify three highly interwoven challenges for media ownership transparency:

The EurOMo analysis for Poland identifies gaps in information concerning the beneficial owners of legacy media, financial statements of smaller private entities, and in the accessibility of ownership data for platform-based news on social media.

Firstly, there is a legal obligation to register press and audiovisual activities, including audiovisual services on YouTube, TikTok, Instagram, and Facebook. However, in the case of some social media channels (such as Make Life Harder and The Poland News), there is no legal basis to disclose the editor-in-chief or establish editorial responsibility. Secondly, some ownership data (including financial data) need to be obtained from official registers or media owners’ websites rather than direct from the outlets. Finally, in some cases, there has been an overall failure to identify beneficial owners, including political influence in media management and politically exposed persons in proximity to editorial policies, strategies, and media companies’ shareholders.

To this end, most Polish news media outlets clearly disclose the names of their CEOs or equivalent senior managing officials on their websites. In some cases, information is less accessible, outdated, or verified only through official registers. Beyond the liberal-conservative polarised dimensions, direct political exposure is less evident among management and shareholders with political affiliations. These have been identified in the case of former politicians, in TVP: including Jacek Bartmiński (Polska 2050), who serves as a member of the Programming Council of TVP and Beata Drożdż from the Law and Justice Party who is listed as chair of the supervisory board of Telewizja Republika. In the context of Kanał Zero, Krzysztof Stanowski used the channel for personal branding to run a satirical residential campaign in 2025, garnering 243,479 votes (1.24%). With Stanowski serving as both a social media figure and a shareholder in the Kanał Zero company (75%), the data is fully legal and traceable, yet the research and methodological lines between journalist, influencer, and political actor remain a challenge.

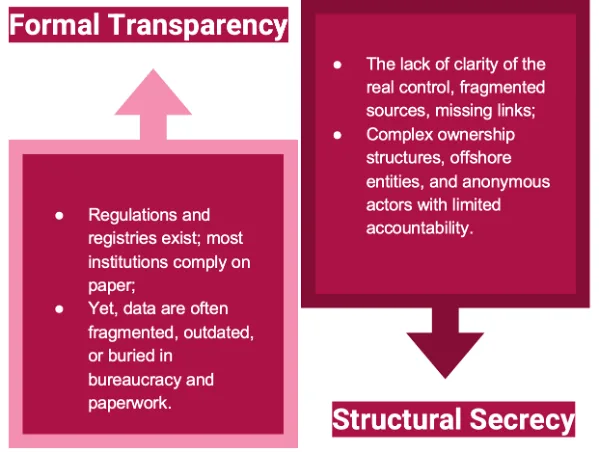

Concerning Polish EurOMo case, we identify the interplay between two contrasting categories of data in the duality of media ownership in Poland. The first concerns the formal transparency and legal arrangements and the second involves structural secrecy with hidden organisational and political interests, of corporations, alongside the socio-cultural lens of relationships—friends vs enemies (Figure 1).

Figure 1. The Duality of Poland’s Media Ownership Transparency

Source: Głowacki, Gajlewicz-Korab, & Sidyk-Furman, 2025, based on EurOMo presentation in Brussels, 20.

Formal Transparency

The Press Law of 1984 sets out the ownership information obligations that apply to the press. The Broadcasting Act (1992) requires the disclosure of ownership and imposes transparency requirements, including the programme title, company name, members of governance bodies, contact details, and jurisdictions. The same applies to the obligation to register a media company and to update the ownership change in the National Court Register (the Central Registration and Information on Business Activity) within seven days. Media companies must disclose state aid (grants and loans) to regulatory bodies in their annual financial reports. However, they are not obliged to disclose revenue from commercial advertising by state companies and other public bodies.

As of December 2025, Poland has yet to adopt the European Media Freedom Act. Recent calls have emphasised the need to reestablish PSM, restore the political independence of the National Broadcasting Council (KRRiT), and introduce safeguards to prevent the misuse of public funds to influence media content. A recent study within the Media Capture Monitoring Report highlights the urgency of requiring media companies to disclose their beneficial ownership. It also recommends assigning responsibility to monitor the impact of state funding allocations and ownership changes on media pluralism and editorial independence. In addition, the competition regulator, the Office of Competition and Consumer Protection, should be required to consult KRRiT when assessing any changes in media ownership that may affect media pluralism and editorial integrity (Dragomir et al., 2025; Głowacki, 2025).

Structural Secrecy

The lack of clarity regarding ultimate control, combined with complex ownership structures, creates fertile ground for multilayered structural secrecy in media ownership transparency. This is evident in cases such as TVN and TVN24, including the TVN24 Facebook profile, where natural-person shareholders are not disclosed, and the full ownership chain remains opaque. Instead, the outlets merely state that they are part of Warner Bros. Discovery, without providing further detail on ownership and control. The importance of structural secrecy is exemplified by the 2023 Oko.press investigation, which argues that RMF FM, Poland’s largest radio station, received tens of millions of PLN in advertising money from the state-controlled oil company Orlen, making it one of the station’s biggest advertisers (Oko.Press, 2023). Furthermore, a Press.pl article describes how a private social gathering attended by politicians and journalists was portrayed by right-wing media as evidence of a “media-political cartel”, framed as improper closeness between the media and politics. The article sparked a public debate about the cultural and political side of parallelisms and the understanding of blurred friendship and family-like social connections (Press.pl, 2024).

This report presents Poland’s 2025 findings from the Euromedia Ownership Monitor (EurOMo), assessing media ownership transparency across legacy media and platform-based news outlets in a highly polarised and increasingly toxic media environment. Conducted under the government led by Donald Tusk and the presidency of Karol Nawrocki, the study identifies persistent structural risks to media pluralism coupled with a high level of socio-political polarisation. The risks to Poland’s media ownership transparency are further amplified by rapid market dynamics, the emergence of new, loosely regulated platform-based news, and expanding overlaps among media activity, political influence, and online personal branding.

The Polish EurOMo dataset identifies three interrelated transparency challenges—data fragmentation, limited accessibility, and constrained traceability—which together undermine effective regulatory oversight. Institutional fragmentation across registries and regulatory bodies results in coverage gaps, leaving some audiovisual outlets and platform-based news providers unregistered or only partially accountable. While financial statements are often formally available, their practical usability is limited by confusion between income, revenue, profit, and beneficial owners, which, in turn, hampers meaningful public scrutiny.

The report argues for a dual understanding of media ownership transparency, namely the ongoing interplay between formal transparency and structural secrecy. On the one hand, legal frameworks provide baseline disclosure obligations but require significant improvement to ensure consistency, accessibility, and enforceability. On the other hand, a cultural and structural approach to secrecy persists, characterised by complex ownership arrangements, shell companies, and cross-border ownership structures.

The EurOMo 2025 findings underscore the need for ongoing, systematic monitoring mechanisms that capture ownership dynamics over time, rather than relying on static disclosures. Both national and international policy priorities include strengthening formal transparency requirements, improving inter-institutional coordination, addressing regulatory blind spots affecting online-only and newly established media actors, and developing tools to better assess economic influence and political entanglements.

Bennett, L.W., & Kneuer, M. (2023). Communication and Democratic Erosion. The Rise of Illiberal Public Spheres. European Journal of Communication, Volume 39, Issue 2. Accessed at https://journals.sagepub.com/doi/abs/10.1177/02673231231217378

Broadcasting Act (1992). Accessed at https://www.gov.pl/web/krrit-en/polish-media-law-1

Dobek-Ostrowska, B. (2019). Polish Media System in a Comparative Perspective. Media in Politics, Politics in Media. Frankfurt am Main: Peter Lang GmbH.

Donders, K. (2021). Public Service Media in Europe: Theory, the Law and Practice. London, New York: Routledge.

Dragomir, M. (2025). Media Capture Monitoring Report: 2025 Overview. Measuring EMFA Compliance [Research Project Report]. Accessed at https://journalismresearch.org/media-capture-monitoring-report/

Głowacki, M., & Kuś, M. (2022). Poland: The polarised model of media accountability. In S. Fengler, T. Eberwein, & M. Karmasin (Eds.), The Global Handbook of Media Accountability (pp. 155-164). Routledge.

Głowacki, M., Jaskiernia, A., Gajlewicz-Korab, K., Łoszewska-Ołowska, M., & Sidyk-Furman, D. (2023). Poland. EurOMo Country Report 2023, accessed at https://media-ownership.eu/2023-edition/findings/countries/poland/

Głowacki, M. (2024). Public Service, No Deliberation. TEXTE 28 (pp. 119-122). ORF Public Value. Accessed at https://zukunft.orf.at/show_content.php?sid=147&pvi_id=2415&pvi_medientyp=t&oti_tag=TexteEnglish

Głowacki, M. (2025). Media Capture Monitoring Report. The International Press Institute and Media and Journalism Research Centre [Research Project Report]. Accessed at https://ipi.media/publications/poland-media-capture-monitoring-report/

International Federation of Journalists (2023). IFJ and EFJ Condemn Continued Political Interference in Public Broadcasting. Accessed at https://www.ifj.org/media-centre/news/detail/article/poland-efj-and-ifj-condemn-continued-political-interference-in-public-broadcasting-1

Jędrzejewski, S. (2024). Media publiczne w erze posttelewizyjnej [Public Service Media in Post-Television Era]. Poltext.

Johnson, C., Bruun, H., Głowacki, M., Iordache, C., Lassen, J. M., Martin, D., Nucci, A., Raats, T., Scaglioni, M. & Świtkowski, F. (2025). Public Service Media in the Age of Platforms. Challenges and Recommendations to the Future. Public Service Media in the Age of Platforms [Research Project Report]. Accessed at accessed at https://psm-ap.com/final-report-challenges-and-recommendations-for-the-future/

Klimkiewicz, B. (2025). Monitoring Media Pluralism in the European Union: Results of the MPM2025. Country Report: Poland [Research project report]. Centre for Media Pluralism and Media Freedom (CMPF), European University Institute. Accessed at https://hdl.handle.net/1814/92903

Money.pl (2025). Sąd na Cyprze zakazał zmian, Solorz pisze do zarządu [A court in Cyprus blocked the changes; Solorz writes to the management board]. Accessed at https://www.money.pl/gospodarka/sad-na-cyprze-zakazal-zmian-solorz-pisze-do-zarzadu-nowe-wiesci-z-imperium-7190684843551488a.html

Oko.press (2023). Radio Muzyka Orlen. Tajemnicze związki największego polskiego radia ze spółką Obajtka [Radio Muzyka Orlen. The mysterious links between Poland’s largest radio station and Obajtek’s company]. Accessed at https://oko.press/rmf-i-orlen-tajemnicze-zwiazki-najwiekszego-polskiego-radia-ze-spolka-obajtka

Press.pl (2024). Politycy i dziennikarze na jednej imprezie [Politicians and journalists at the same party]. Accessed at https://www.press.pl/tresc/85222,politycy-i-dziennikarze-na-jednej-imprezie_-_przyszli-znajomi-adwokata_

Press.pl (2025). Jest zgoda UOKiK na połączenie Fratrii i Apelli. Nadawca wPolsce24 i agencja od SKOK-ów [UOKiK approves the merger of Fratria and Apella. The broadcaster wPolsce24 and an agency linked to SKOKs]. Accessed at https://www.press.pl/tresc/88861,jest-zgoda-uokik-na-polaczenie-fratrii-i-apelli_-nadawca-wpolsce24-i-agencja-od-skok-ow

Reporters Without Borders (2025). Pressure on Public Media. A Decisive Test for the European Democracies. Accessed at https://rsf.org/en/rsf-publishes-new-report-protect-europe-s-public-media

Reuters Institute (2025). Country Report: Poland. Accessed at https://reutersinstitute.politics.ox.ac.uk/digital-news-report/2025/poland

Štětka, V. & Mihelj, S (2024). The Illiberal Public Sphere: Media in Polarized Societies, Palgrave Macmillan.

The Press Law (1984). Accessed at https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=wdu19840050024

Tomaz, T. (2024). Media ownership and control in Europe: A multidimensional approach. European Journal of Communication, 39(5), 498–511. https://doi.org/10.1177/02673231241270994

Wirtualnemedia.pl (2025a). Kto wygrał rok 2025 w telewizji? Mamy zestawienie TOP 30 stacji [Who won television in 2025? We present the TOP 30 TV channels]. Accessed at https://www.wirtualnemedia.pl/kto-wygral-rok-2025-w-telewizji-mamy-zestawienie-top-30-stacji,7240992564099584a

Wirtualnemedia.pl (2025b). Sukcesja w “Super Expressie” i Radiu Eska. Zbigniew Benbenek przekazał akcje córce [Succession at “Super Express” and Radio Eska. Zbigniew Benbenek has transferred his shares to his daughter]. Accessed at https://www.wirtualnemedia.pl/zbigniew-benbenek-corka-agata-benbenek-to-nowy-wlasciciel-super-expressu-i-radia-eska,7226302236125952a

Wirtualnemedia.pl (2025c). Po przejęciu “Rzeczpospolitej” zmiany we władzach PTWP. Były szef Eurozetu ma nadzorować [After the acquisition of “Rzeczpospolita,” changes in PTWP’s management. Former Eurozet CEO to take on a supervisory role]. Accessed at https://www.wirtualnemedia.pl/po-przejeciu-rzeczpospolitej-zmiany-we-wladzach-ptwp-byly-szef-eurozetu-ma-nadzorowac,7225381797857824a